KOSPI Overnight Futures Volume Surges After Snap Election

On June 3 (KST), trading activity in KOSPI200 overnight futures spiked dramatically following the announcement of South Korea’s snap presidential election results. The election was triggered by the impeachment of President Yoon Suk-yeol, a rare and politically charged event that sent ripples through financial markets. While prices showed only moderate movement, the surge in trading volume indicates heightened investor interest and uncertainty.

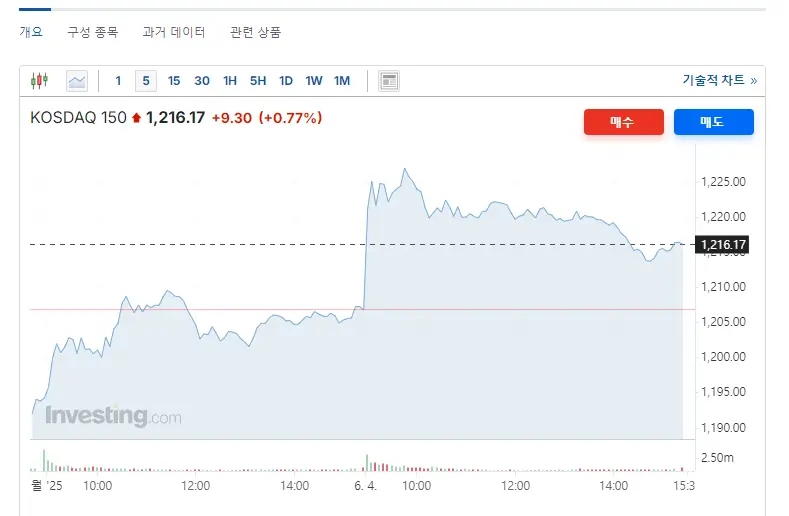

Investors closely monitored movements through the (KOSPI200 야간선물), where real-time data reflected this uptick in trading volume.

Yoon’s Impeachment and Early Election

President Yoon Suk-yeol was impeached by the National Assembly amid escalating public backlash over alleged abuse of power, mishandling of key economic policies, and political deadlock. The Constitutional Court upheld the impeachment, leading to a snap election that was held earlier than the scheduled 2027 vote.

The political vacuum and uncertainty surrounding future leadership immediately caught the attention of global investors. Historically, South Korea has experienced sharp short-term volatility following major political events, though long-term economic fundamentals tend to remain intact.

Legal and Political Shocks in Market Pricing

In emerging markets like South Korea, legal or constitutional crises often trigger short-term market reactions due to uncertainty in policy direction, regulatory enforcement, and geopolitical alignment.

However, not all such events impact asset prices equally. In the case of Yoon’s impeachment, the KOSPI index remained relatively stable. This reflects a belief among institutional investors that the rule of law prevailed, and that the political transition would be orderly.

Instead, market sentiment shifted toward hedging and short-term positioning which is more clearly reflected in derivatives markets, especially the KOSPI200 futures.

Legal and Political Shocks in Market Pricing

In emerging markets like South Korea, legal or constitutional crises often trigger short-term market reactions due to uncertainty in policy direction, regulatory enforcement, and geopolitical alignment.

However, not all such events impact asset prices equally. In the case of Yoon’s impeachment, the KOSPI index remained relatively stable. This reflects a belief among institutional investors that the rule of law prevailed, and that the political transition would be orderly.

Instead, market sentiment shifted toward hedging and short-term positioning, which is more clearly reflected in derivatives markets, especially the (KOSPI Overnight Futures).

Surge in KOSPI200 Overnight Futures Trading

While the spot index showed little movement, the KOSPI200 overnight futures market saw a sharp uptick in trading volume. This indicates that investors were actively managing exposure and preparing for possible volatility in the coming weeks.

Night futures serve as a sentiment barometer for global investors, especially since they trade during U.S. market hours and reflect overseas expectations for the Korean market.

Traders may not be betting on a crash or rally, but rather navigating heightened uncertainty by increasing activity in futures contracts an efficient way to hedge against news-driven volatility without making large directional bets.

Impact on Broader Derivatives Policy

The sudden spike in overnight futures trading also had downstream effects on financial regulation. Starting in June, authorities had been preparing to roll out new operational guidelines for Korea’s secondary market instruments. The heightened trading volatility accelerated discussions around risk management frameworks.

Particularly, adjustments were observed in the policy outlook for (코스닥 야간선물), which began official sales this month. Regulators are reportedly considering tighter oversight mechanisms and enhanced transparency measures for these instruments.

Conclusion

The impeachment of President Yoon Suk-yeol and the subsequent snap election introduced political turbulence but also highlighted the resilience and maturity of South Korea’s financial markets. While the KOSPI index held steady, investor behavior clearly pivoted toward short-term risk positioning.

This was most evident in the activity surrounding KOSPI Overnight Futures, where trading volumes surged dramatically. Derivatives markets once again proved to be leading indicators of sentiment during periods of institutional uncertainty. As regulatory responses evolve, especially with instruments like 코스닥 야간선물, market participants will be watching closely for further shifts in South Korea’s financial architecture.